· Overall value of assisted digital financial transactions at PayNearby retail stores stood at ~Rs. 54,000 Cr (USD 7.5Billion) in FY 20-21

· On an average, PayNearby disbursed Rs. 3,000+ Crore of AePS withdrawals per month in FY 20-21

· After an initial drop, resurgence of remittance in the second half of the year, combined with increased offtake in insurance, digital payments, Micro ATM, recharges and bill payment contributed to the growth

· New categories, including flexi savings product, Bachat Khata saw a growing offtake in the second half of the year

· Online offline convergence, where ecommerce companies, online education and video streaming providers made their services available through PayNearby retail stores, was another rising category

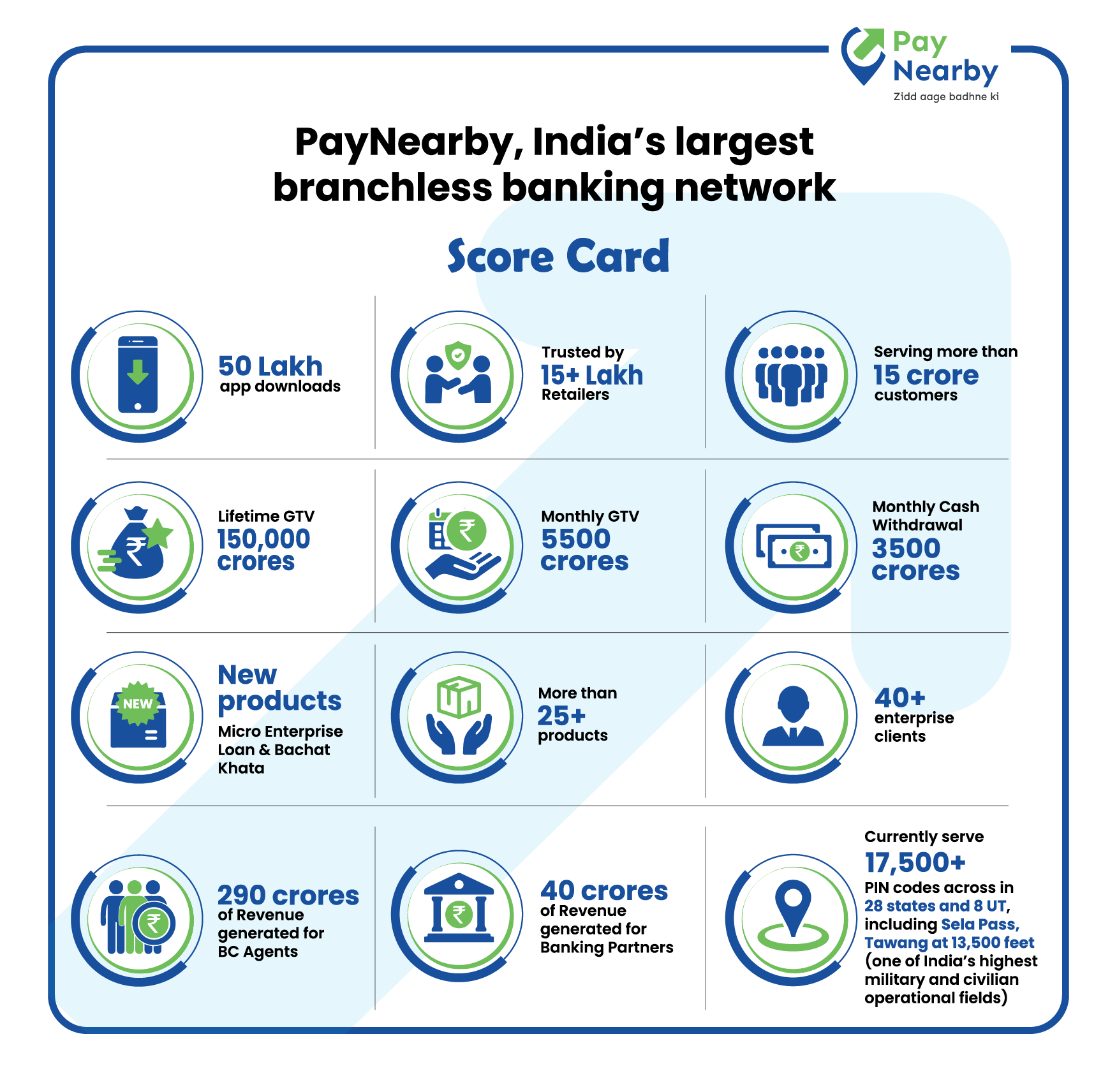

· Assisted financial transactions were registered across 17,500 PIN codes in the country, with a new milestone of 50 Lakh app downloads achieved

· PayNearby generated ~Rs. 290 Crores (USD 40 Million) of revenue for its banking agents, and about ~Rs. 40 Crores (USD 6 Million) of fee was paid to its banking partners in the last financial year

PayNearby, India’s leading branchless banking and digital payments network today announced that it has recorded Gross Transaction Value (GTV) worth Rs. 54,000 Crores in FY 20-21, with an exit month GTV 32% higher than the average monthly GTV booked in FY 19-20. The company generated ~Rs. 290 Crores of revenue for its retail partners and about ~Rs. 40 Crores of fee for its banking partners in the same financial year. Amidst the pandemic, the generation of stable income opportunities for its partnering retail community ensured steady livelihood across lakhs of household across the country.

FY 20-21 saw irreparable loss both in lives and livelihoods among many, and agent banking network played a crucial role in ensuring relief disbursements reach the hands of the intended. Aadhaar ATM, which is the backbone for disbursing DBT to citizens, saw a huge surge across PayNearby retail stores, primarily led by increased adoption in rural, semi urban and tier 2 towns. The company reported AePS withdrawals worth Rs. 10,000 Crores in Q4 FY 2021 as against Rs. 7,650 Crores for the same quarter last year.

The overall value of AePS transactions in FY20-21 stood at approximately Rs. 40,000 Crore as against Rs. 31,500 Crore in FY19-20, thereby registering a Y-o-Y growth of 27%. In terms of volume, the company registered 18 crore (180 million) transactions in FY20-21 as against 12.5 crore (125 million) in FY19-20, registering a Y-o-Y growth of 46%. The growth all through FY20-21 included various relief funds disbursed by the Government to support citizens during the pandemic in addition to the normal ATM withdrawals that were assisted by the Agent network.

When the economic crisis intensified during the lockdown phase, the country witnessed a mass movement of the migrant community from metros to their respective hometowns. During this period, Domestic Money Transfer (DMT), or the amount of money sent home by migrant workers, saw a sharp decline of more than 85% in the first two months, and started picking up again by late July. With the advent of the unlock phase, remittance business saw a V shaped recovery and registered a growth of 106% and 100% in value and volume respectively vis-à-vis lockdown. The company reported a Gross Transactional Value of Rs. 12,000 Crores in its money remittance business for FY 20-21 with a gross monthly average of Rs. 1,300+ Crores in the last 6 months, similar to its run rate in the second half of FY 19-20.

Overall value of assisted digital transactions at PayNearby retail stores for Q4 FY2021 stood at Rs. 15,200 Crores as against Rs. 11,700 Crores for the same quarter last year, representing a growth of close to 30%. In addition to growth in AePS transactions, newer product categories like flexi savings instrument (Bachat Khata), COVID insurance, increase in digital payments offtake including mPOS, UPI QR, AadharPay and Payment Gateway services led to the growth. The company’s efforts to democratize digital services and make ecommerce, online education and online video streaming available to every citizen in the country also saw good acceptance among its retail partners and is one of the rising categories in its portfolio. EMI collection service for 33 leading FIs, NBFCs and Micro Finance companies came as a savior to many of these partners, whose customers wanted to pay EMIs but the collection teams couldn’t reach them during this pandemic. Cash collection for online delivery partners and EMI collection services witnessed 2x growth in FY 2021.

The total numbers of transactions stood at 7+ crore in Q4 FY2021 vis-à-vis 5 crore for the same period last year, thus registering a growth of over 45%. The company further stated that it served financial transactions worth Rs. 280 Crore ($40 million) on multiple days in FY 21, with an average of Rs. 150 Crore on a daily basis.

Speaking on the progress, Anand Kumar Bajaj, Founder, MD & CEO said, “Our assisted digital distribution services ensures low cost delivery of accessible banking services to every section of the society without discrimination. Tech savvy and oblivious segments both access our Agents for ATM withdrawals, digital payments, bike insurance, small value savings and booking travel tickets. The steep rise in volume and values across our platforms are a testimony to a burgeoning revolution within the digital banking ecosystem. The numbers are a clear reflection that real Bharat in tier-II cities and beyond are adopting digital services through their trusted local stores nearby. We need to port this local trust and layer it with the right tools, training and technology to universalize digital payments and digital banking in India.

At 50 Lakh app downloads and an annual transaction processing of ~Rs.54,000 Crores of digital financial services, we are still at the tip of the iceberg. There is a large unexplored, underserviced market which needs to be brought up the curve by simplifying high end technology for the bottom of the pyramid. We will continue to innovate every single day to ensure form factor agnostic digital payments and digital banking services reach the masses. As we yet again enter the second wave of the pandemic, it is critical to cement financial architecture to ensure seamless access to financial services in the hinterlands of the country.”

Anand further added, “We also feel extremely fortunate to be able to provide stable income opportunities for our Digital Pradhans. It has ensured families across the country had the means to sustain this economic turmoil. Our focus on our Digital Pradhan’s growth and sustainable livelihood will always remain a priority objective at PayNearby.”

The company represents the country’s largest retail merchant network today with more than 2 Crore customers serviced monthly.

PayNearby has played a significant role in driving digital financial services within the interiors of the country across 17,500+ PIN codes. It has bolstered easy, low-ticket transactions and created an all-inclusive acceptance framework for a less-cash India.

The company recently celebrated a new milestone with more than 5 million PayNearby app downloads by retailers. Besides enabling financial access and payment digitization at the last mile, the company has been empowering small merchants, SMEs and local businesses to adopt contactless payments and digitize themselves. The company also launched PayNearby app in 10 local languages for seamless communication across semi-urban and rural markets.